“Nothing so weakens government as persistent inflation.”

– John Kenneth Galbraith

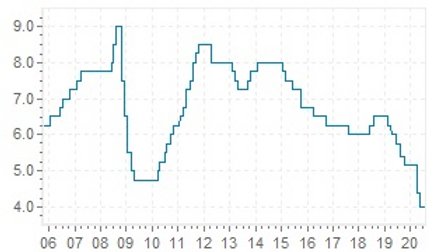

What caused the treasured Parle-G to go from ₹3.75 in 1994 to ₹10 & 1 tola gold from ₹4,400 in 2000 to nearly ₹54,000 in today’s times? Inflation!! It went from 3.83% in 2000 to an astonishing 12.31% in 2009 & back to 3.34% this year. Inflation is inevitable.

So, how does the Indian Government prevent a 1923 Germany,a 1998 Rwanda, or the ongoing hyperinflation in Venezuela. It tries to maintain fiscal discipline (plugging the gap between income and expenditure) and uses the 5 most effective weapons in RBI’s arsenal: Cash Reserve Ratio (CRR), Statutory Liquidity Ratio (SLR), Repo Rate, Reverse Repo Rate & the Bank Rate.

1. Cash Reserve Ratio

The percentage of deposits which a bank must keep as cash reserves with the RBI is called the CRR. The current CRR is 3%. It means that for every ₹100 deposited, banks must keep ₹3 as cash with the RBI at all times.

In times of inflation, RBI increases the CRR thus, reducing the lending capacity of commercial banks & ultimately, the money supply in the economy.

2. Statutory Liquidity Ratio

SLR is the minimum percentage of deposits(demand & fixed) that the bank has to maintain in form of gold, cash, or other RBI- approved securities like government bonds. The current SLR is 18% implying that for every ₹100 deposited, banks must maintain ₹18 in the form of cash, gold, or securities.

RBI increases the SLR to restrict banks’ lending capacity & control inflation by soaking up excess liquidity from the market.

3. Repo Rate

Repo Rate, also known as a repurchase agreement, is the rate at which banks borrow money from RBI by selling its approved securities to RBI. Usually, money is borrowed for a duration of up to 2 weeks. The current repo rate is 4%.

It is increased during high inflation to increase the cost of short-term credit thus dissuading banks from borrowing more money.

4. Reverse Repo Rate

It is the rate of return on surplus funds parked by banks with the RBI. Banks do this when they have no investment/lending options available. The current rate is 3.35%.

During Inflation, the Reverse Repo rate is increased causing banks to deposit more funds with the RBI and lend less to the public leading to a fall in money supply in the economy.

5. Bank Rate

Commercial banks may take loans to meet their long-term credit needs from the central bank. The interest charged on these loans is called Bank Rate. The current Bank Rate is 4.25%.

In a time of high inflation, the Bank rate is increased to deter banks from borrowing, thus reducing their lending capacity leading to the decreased money supply.

But how do these measures, involving colossal banks & the RBI, affect the average Indian?

Let’s take the case of the repo rate.

On August 7, 2019, RBI cut the repo rate by 35 basis points (bps)(= 0.35%). In line with the reduction, the State Bank of India (SBI) reduced interest rates on FD by 50-75 bps for short tenures (up to 179 days) and 20 bps for longer tenures. On the other hand, SBI reduced the interest rate on fresh loans by 29 bps, and HDFC followed with a similar 10 bps cut.

So basically, a cut in repo rates makes deposits less attractive while making loans cheaper.

When CRR is increased, the amount of funds that a bank can lend decreases. Banks then try to encourage more deposits by increasing the interest rates. The rising interest rates usually discourage loan seekers as a higher interest rate means that the cost of money has increased.

Hence, a hike in CRR is beneficial for depositors but disadvantageous for loan-seekers.

Understanding these measures & their effects on us & the economy as a whole is vital so that the next time you think of opening a new FD, you take a quick glance at the current repo rate & decide whether it is better than that low-risk Treasury bill or government bond that you’ve been eyeing for some time.

Subscribe to The Fin Lit Project and join our community of finance learners to make sound financial decisions and understand financial jargon in simple language better.